2016 Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) Awareness Seminar and Training Workshop

The Nevis Financial Services (Regulation and Supervision) Department (NFSD) held its annual Anti-Money-Laundering/ Countering Financing of Terrorism (AML/ CFT) Awareness Seminar and Training Workshop on 21st and 22nd March 2016 at the Four Seasons Resort, Nevis.

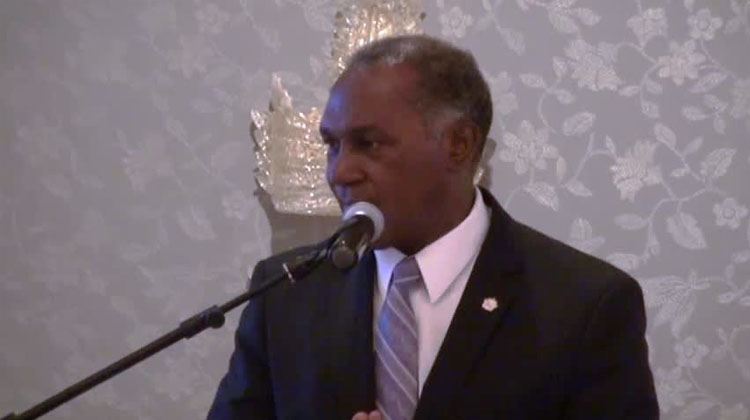

Read MoreNevis Premier addresses participants at AML/CFT Seminar and Training Workshop

Premier of Nevis and Minister of Finance Hon. Vance Amory expressed hope that participants at the 11th annual Anti-Money Laundering (AML)/Counter Financing of Terrorism (CFT) Seminar and Training Workshop, would come up with practical solutions on what else small developing countries could do to find their feet in the international arena, provide jobs for their people and revenue for development.

Read MoreExtension to Comply with FATCA Reporting

Financial institutions that are required to comply with the United States of America’s (USA’s) Foreign Account Tax Compliance Act (FATCA) are asked to note that the US Treasury Department has issued Notice 2015-66 which provides for some relief from the deadline of 30 September 2015 for exchange of information by Foreign Governments that have a signed Inter-Governmental Agreement (IGA) or have reached an agreement in substance with the USA.

Read MoreFATCA Competent Authority for the Federation of St Kitts and Nevis begins online enrollment of Financial Institutions for FATCA reporting

The FATCA Competent Authority for the Federation of Saint Kitts and Nevis announces the start of online enrollment and data submissions for ALL Financial Institutions registered with the United States Internal Revenue Service (IRS) as Foreign Financial Institutions (FFIs).

Read MoreThe Federation of Saint Kitts and Nevis and the United States of America Sign Agreement to Improve International Tax Compliance and to Implement FATCA

The Governments of the Federation of Saint Kitts and Nevis and the United States of America (USA) on 31 August 2015, signed an InterGovernmental Agreement (IGA) that will facilitate compliance by financial institutions in the Federation with the USA’s Foreign Account Tax Compliance Act (FATCA).

Read More